Only one method may be used per vehicle, with some exceptions. There are two methods that can be used to deduct vehicle expenses, Standard Mileage and Actual Expenses.

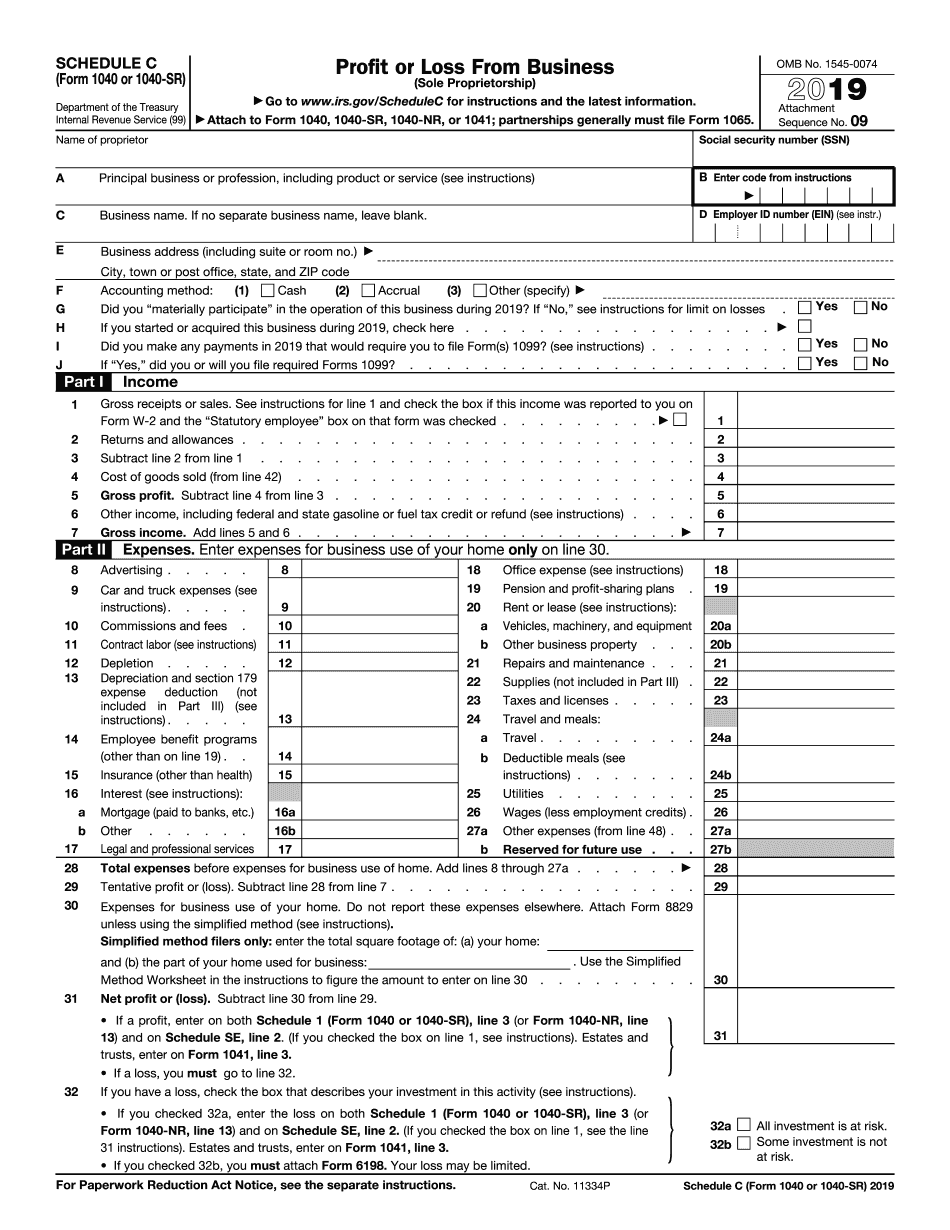

When you print the return, a supporting statement will generate listing each of these items. The amount entered for each item will total together and carry back to the expense line. If you have more than one item that falls under the supplies category, repeat the steps above to enter item. Select the New button and type in a description of the expense, such as Paper. For example, when entering Supplies select the F10 key on your keyboard. When entering expenses, you can create supporting notes to keep track of each expense. For more information on entering expenses and depreciation, see To Enter Schedule C Expenses below.Įxpenses incurred by the business can be deducted inside the Expenses Menu. Depreciation and car & truck expense, such as standard mileage and actual expenses, can be entered in the expense menu. Expense items such as advertising, repairs, utilities, and meals & entertainment can be deducted.

If current year's activity has a net loss, an amount entered here will cause an incorrect calculation. CAUTION: Only enter an amount here if the current year's activity is a net profit.

#Schedule c tax form code#

Peruse the list to determine the best code, then enter the code or

#Schedule c tax form pdf#

Select the icon above "Click Here To View Entire List Of codes" to display a list of codes in PDF form.If you do not know the code, you can search for it in two ways: This is a code used by the IRS to classify the type of business being operated. Enter the six-digit Principal Business Activity Code.If the return is being filed MFJ, you will be asked who the Schedule C is for, whether the taxpayer, the spouse, or if it's a qualified joint venture.If you have one or more Schedule Cs in the previous year and wish to pull their data forward, select Pull.From the Main Menu of the tax return (Form 1040) select:

0 kommentar(er)

0 kommentar(er)